20 Dic What Is the Difference Between Ticket Size and Tex Size for Bonded Thread?

Newbies should stay out of these investments, even if they have the funds. A PMS, for instance, may invest in a concentrated portfolio and follow niche strategies that may result in severe volatility in returns. A mutual fund, when compared to a PMS, is a vehicle for the masses. It is much more diversified and the fund manager cannot take undue risks. Large tickets restrict the ability to sell Investments that have high entry barriers typically also have restrictions when you sell.

Ticket size is not an exact calculation and due to minor differences in denier between substrates, different final denier sizes may lend to the same final ticket size. The tex size of thread is just one of several numbering systems that are classified as either direct or indirect systems. It is the weight of a fixed-length rather than the length of a fixed weight .

Broker/dealers will often follow average ticket size per client on a daily basis, reporting average trades in dollar amounts per day. For example, in 2021, Charles Schwab reported their daily average revenue per trade was $2.54, up from $2.16 a year earlier. Computing average ticket size is computing the mean, which is calculated as the total sales divided by the number of customers.

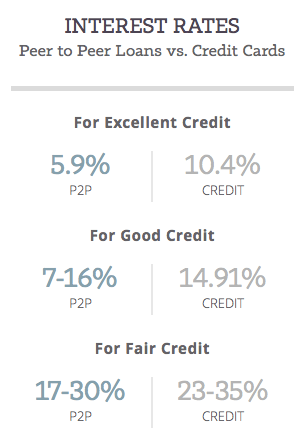

One of the most helpful ways to use average ticket sales is as a measurement to see whether the measures you’re taking to increase sales are working. For instance, if you decided to offer discounts to increase sales, you might see your average ticket size rise if your loyal customers began to purchase more per visit. Credit card businesses also follow average tickets when analyzing credit card transactions by customers.

A real-estate property that takes up around, say 50 percent of your overall portfolio, would be hard to sell if the property market is cold. When you accumulate units of equity mutual funds over many years, you have the option of selling everything in one go or in small lots. Sometimes, minimum investment becomes some sort of a constant commitment. When you open a public provident fund account, you are effectively agreeing to pay each year. If you fail to do so, a small penalty of Rs 50 is payable for each unpaid year.

Investments are generally analysed on parameters such as safety, liquidity and returns. However, rarely do investors consider the ticket size as an important factor while evaluating an investment. In reality, a high entry barrier is often the first indication of whether you are suited for such an investment. Ticket size is nothing but the minimum amount that an investment avenue requires.

What Is Ticket Size in Sales?

Bonded thread size is communicated in various ways, mainly by ticket number and tex size. Although it’s easy to get caught up in the lingo and confuse the two, the ticket number and tex size are distinct characteristics of a bonded thread. Generally, broker/dealers only operate on business days, which gives them fewer active days for calculating transactions and revenue than other retail businesses. The average fee per card is also another closely followed metric for credit card companies. So if 1,000 meters of a particular thread weighs 30 grams, it would be labeled tex 30, and if it weighs 35 grams, it would be tex 35, and so forth.

The average collection period is the amount of time it takes for a business to receive payments owed by its clients in terms of accounts receivable. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

A credit card company’s average ticket refers to the average amount charged on credit by customers. So, if your net sales for the month was $50,000 and you had 1,000 customers checkout, you had an average ticket size of $50. For example, American Express reports one of the highest average ticket levels across the credit card industry. In 2021, the company reported average annual basic card member spending by customers globally of $20,392. Ticket size is a manufacturer’s reference to the final denier size of a given thread, with denier being the weight in grams of 9,000 meters of thread.

The minimum investment or commitment often shows you a vehicle’s nature. High ticket sizes are not bad; they’re just not meant for everyone. The average ticket size measurement helps businesses understand sales trends and their overall profitability. Companies vary in the time frames they use for calculating average ticket sales. Generally, other statistics around the average ticket value are also reported to help provide a range, such as the lowest ticket, highest ticket, and median ticket. Broker/dealers calculate average ticket size when analyzing trade data by customer.

It’s vital to make the right choice for your specific application and industrial processing setup. For more assistance with making the right thread selections, contact Service Thread. Here’s a look at what each of these terms means, as well as some tips on understanding the differences between them.

Calculating Average Ticket Size

The term “tex size” most likely derives from the word “textile” and is a universal measurement that allows consistency in sizing. The International Organization for Standardization , a global consortium of standards experts, prefers tex sizing for yarn and thread over other methods of measurement. Thus, whenever there is no quantity bid at a particular price, that particular price is not shown in the bid column, instead the price at the next tick (i.e. 0.05) is shown. This goes on till a maximum of five bid prices are visible in the column. To learn more about this topic, we encourage you to read our related blog post that explains industrial sewing thread sizes. Ticket numbers typically resemble the fixed weight system, whereby the higher the number the finer the thread, and lower numbers will be thicker threads.

But the stakes can be high if you sign up for an investment product offered by life insurers. If the commitment to pay your annual premium runs in lakhs, it can be a tricky situation in case of loss of job or income. The minimum premium payment tenure for most regular premium policies is five years, but in some cases it can be more. If you fail to pay all instalments, then the benefits of such policies may not be paid.

- It is much more diversified and the fund manager cannot take undue risks.

- If the commitment to pay your annual premium runs in lakhs, it can be a tricky situation in case of loss of job or income.

- The International Organization for Standardization , a global consortium of standards experts, prefers tex sizing for yarn and thread over other methods of measurement.

- Sometimes, minimum investment becomes some sort of a constant commitment.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Average ticket size is an excellent way to gauge the effectiveness ticket size meaning of marketing campaigns. Value at risk is a statistic that quantifies the level of financial risk within a firm, portfolio, or position over a specific time frame. You add up the value of your total daily sales and divide it by the total number of sales for the day .

What Is Average Ticket?

Average ticket size measures how much customers spend per visit on average. So a medium-weight cotton at 1,000 meters might be tex 25, while a heavy-duty cotton at 1,000 meters might be tex 72. Average ticket is a metric that provides details on the average amount spent per customer per visit.

Ticket Size

NCDEX seeks Sebi nod for nickle, aluminium optionsThe exchange is also keen on options trading in more agri-commodities. Revenue per available room is calculated by multiplying a hotel’s average daily room rate by its occupancy rate. Days payable outstanding is a ratio used to figure out how long it takes a company, on average, to pay its bills and invoices. It is used by many businesses when analyzing business performance, sales activity, and profitability.

GET OUR RSS FEED

Erika Rasure is globally-recognized as a leading consumer economics subject matter expert, researcher, and educator. She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

No Comments