07 Oct Understanding Form 941

You get an additional 10 business days to file if you’ve paid your employment tax deposits in full and on time for the entire quarter that’s covered by the return. Generally, any person or business that pays wages to an employee must file a Form 941 each quarter, and must continue to do so even if there are no employees during some of the quarters. The only exceptions to this filing requirement are for seasonal employers who don’t pay employee wages during one or more quarters, employers of household employees and employers of agricultural employees. You must file IRS Form 941 if you operate a business and have employees working for you. Certain employers whose annual payroll tax and withholding liabilities are less than $1,000, might get approval to file the annual version—Form 944. On top of facing penalties for failing to file your tax return, you will also be charged an initial penalty of 0.5% of the unpaid tax amount if you also did not pay the taxes owed.

Ministers are self-employed for Social Security with respect to their ministerial services (see IRS Publication 517). This means that they pay the “self-employment tax” (SECA) rather than the employee’s share of Social Security and Medicare taxes—even if they report their federal income taxes as a church employee. It is incorrect

for churches to treat ministers as employees for Social Security and to withhold the employee’s share of Social Security and Medicare taxes from their wages. The government requires employers to pay these withholding taxes on a monthly or semiweekly schedule, not in a lump sum.

TURBOTAX ONLINE GUARANTEES

Once you complete these calculations in lines 5a through 5d, you’ll add Column 2 from these lines and fill in the total on line 5e. Then, on line 6, you’ll add lines 3, 5e and 5f (if applicable) to calculate your total taxes before adjustments and fill in that total. File this form quarterly to report federal withholdings from employees and avoid penalties and fees. If your organization is new and you had no tax liability for previous quarters, your lookback period is considered $0, which means you’re likely a monthly depositor. Now that we’ve covered what Form 941 is, let’s discuss how to file the quarterly tax form. You can find the current version of the form and complete instructions on the IRS website2.

You’ll provide your employer identification number (EIN), business name, trade name (such as a DBA), and address. Namely processes over $10 billion in annual payroll and handles tax compliance for over 1,000 companies. Learn more about our payroll software or watch a live demo of our platform here. As an employer, this means you have an entire month to get your payroll Form 941 in order before the deadline hits.

Where To Mail 941 With Payment

Form 941 must be filed on a quarterly basis (every 3 months) every year. However, if you have employees whose annual payroll tax withholding liabilities are less than $1,000, you may be able to file on an annual rather than quarterly basis. If you use payroll software or accounting software, you should be able to retrieve the data you need for IRS Form 941.

To ensure compliance and avoid potential issues, it’s always a good idea to get professional help with it. The team at Paytime is ready to help you navigate your reconciliation of Form 941 to payroll and support you in all of your payroll and HR-related needs. You’re able to file Form 941 online via the IRS website, and you must use the EFTPS.gov service to transfer funds electronically. If you’re a semiweekly depositor — meaning you have more than $50,000 for tax liability for the quarter — you’ll complete Form 941 Schedule B and attach it with this form. Schedule B breaks down your tax liability for each day of the quarter.

More In Forms and Instructions

For best results, reconciliation should be done on a quarterly and a year-end basis. Unlike individual taxpayers who have to file only one tax return per year, many businesses are required to file quarterly tax returns. Failure to file IRS Form 941 on time or underreporting your tax liability can result in penalties from the IRS. IRS Form 941 is used to report and pay employees’ federal income tax and employee and employer Medicare and Social Security taxes. Note that most quarterly payments for federal unemployment taxes—which are not reported on Form 941—must also be paid by these dates. Many businesses choose to calculate and pay their unemployment taxes when filling out Form 941 since similar information is required.

If this updated amount is higher than the amount you deposited with the IRS over the quarter, you’ll need to calculate the difference. For each month or part of a month your return is late, the IRS may charge a penalty of 5% of the tax due up to a maximum of 25%. If your business pays the taxes you owe late or underpays, you may be charged an additional penalty of 2% to 15% of your underpayment. Most businesses that pay wages to one or more employees at any point during a calendar year need to file Form 941. This includes S-corporations that only have a single employee. Businesses typically need to file Form 941 every quarter, even if there are quarters in which they have no employees.

Tax 101

If you don’t want to be among the many small businesses that don’t succeed in their first three years, it’s extremely important that you stay on top of deadlines and penalties. After accounting for all of these items, IRS Form 941 will tell you how much money you should have paid or will need to pay to the government to cover your payroll tax responsibilities for the quarter. If you choose to file your 941 by mail, you can either fill out the form on your computer and print it, or print the form first and complete it by hand (mailing instructions are in the next section). Electronic filing can be done online with the Modernized e-file (MeF) system on irs.gov.

If any of the above deadlines fall on a bank holiday or weekend, note that they are pushed to the following business day. Determine whether your business is a monthly or semi-weekly depositor. Semi-weekly depositors are typically businesses with more than $50,000 in tax liability for the quarter and must fill out Form 941 Schedule B. One of the many ways in which businesses fail is by getting behind on their taxes and the penalties that result.

Can Form 941 Be Filed Electronically?

Failure to file a Form 941 in time may result in a penalty of 5 percent of the tax due with that return, and can increase up to 25 percent. Just remember that the filing deadline always falls on the last day of the month following the end of the quarter. This gives you one month to prepare the form before submitting it to the IRS. On page five, provide an explanation of how you determined your corrections, which should include that you are amending your return to apply for ERC.

- You need to complete this if you end up owing the IRS additional taxes.

- Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page.

- As the employer, you are responsible for making an additional payment to the IRS equal to all Medicare and Social Security taxes withheld.

- A third-party designee might be your CPA, enrolled agent or tax advisor.

- Add the resulting numbers together to the amount you specified for income taxes earlier (box 3), and you’ll then have your total taxes owed.

If you need to make a payment, you can do so through the EFTPS — Electronic Federal Tax Payment System. Any tax payments related to Form 941 can be made through EFTPS. Accounting for these items will result in a total amount of money you will need to pay to cover your payroll tax responsibilities for the quarter. To finish this section, you’ll check the box that applies to you, either monthly, semiweekly, or less than $2,500.

Finalize the form by signing your name and filling out Part 5 above the Paid Preparer Use Only section. However, to claim this benefit, you’ll need to file Form 941-X. If you wish for the IRS to be able to speak with your accountant or tax preparer about this return, indicate so and provide their contact information. Are you ready to complete Form 941, the Employer’s Quarterly Federal Tax Return? It’s an important filing for employers, and understanding how to fill it out correctly is critical. – Be the first to get notified on new clergy tax, church payroll and HR updates.

IRS Form 940 vs 941: What are the main differences? – Marca English

IRS Form 940 vs 941: What are the main differences?.

Posted: Sun, 05 Mar 2023 08:00:00 GMT [source]

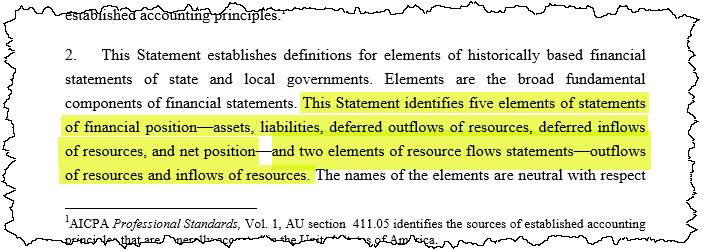

In box 1, you’ll provide the number of employees at your organization who received wages, tips, or other compensation for the quarter. In box 2, you’ll provide the total wages, tips, and other compensation for all of your employees for the quarter. In box 3, you’ll add the federal income tax you withheld from wages for the quarter. IRS Form 941, also known as the Employer’s Quarterly Tax Return, is a form employers use to report any federal income tax, Social Security tax, and Medicare tax withheld from their employees. This information is then used to calculate your employment taxes. Enter the number of employees your business had last quarter, the total your business paid in wages and tips, and the total amount withheld from employees for federal income tax.

- The adjustments for sick pay and life insurance come into play if, for instance, an insurance company reimbursed a portion of your employee’s wages while they were on short-term disability.

- If you operate a business and have employees working for you, then you likely need to file IRS Form 941, Employer’s Quarterly Federal Tax Return, four times per year.

- Seasonal businesses only need to file for the quarters in which they are operating.

Add the resulting numbers together to the amount you specified for income taxes earlier (box 3), and you’ll then have your total taxes owed. Form 941 is a quarterly report of wages paid to employees and withholdings made by employers. It also includes information on the employer’s share of Medicare and Social Security taxes during the period reported. Each year, Americans dutifully complete their annual tax returns to report what’s been paid to the federal government and what might still be owed. Your HR and payroll teams also have their own IRS filing obligations.

No Comments