08 Feb Examples of fixed assets

For instance, a company may have acquired a piece of machinery for $100,000 five years ago. Under this classification, assets are identified as being either operating assets or non-operating assets. Return on invested capital (ROIC) is a calculation used to assess a company’s efficiency at allocating the capital under its control to profitable investments. Return on invested capital gives a sense of how well a company is using its money to generate returns. On the other hand, it would not be able to sell its factory within a few days to obtain cash as that process would take much longer.

Depreciation Is a Process of Cost Allocation

These incentives not only make it more financially feasible to invest in high-cost assets but also align business activities with broader policy goals, such as sustainability and innovation. Understanding and leveraging these tax benefits requires a thorough knowledge of current tax laws and regulations, making it essential for businesses to consult with tax professionals or advisors. Securing the necessary funds to acquire and maintain fixed capital is a fundamental aspect of business strategy. Companies often explore a variety of financing options to ensure they have the resources needed to invest in long-term assets. One common method is through equity financing, where businesses raise capital by issuing shares of stock. This approach not only provides the necessary funds but also brings in new investors who may offer valuable insights and connections.

Financial management

Instead, you can list fixed assets as line items over the period you own them. The method you choose will depend on the type of asset and how they are used. It helps to use real-world examples and strong processes to discover what’s best for your fixed assets and financial reporting. Company ABC is a construction company that plans to purchase a second building for $15 million. The building is a tangible asset and, if the company keeps the building for more than one year, it becomes a fixed asset. However, the value of the building, $15 million, will be reported as a fixed asset on the balance sheet.

Great! The Financial Professional Will Get Back To You Soon.

These assets are fundamental to the production process and often represent a significant portion of a company’s total capital investment. For instance, a manufacturing plant relies heavily on machinery and equipment to produce goods efficiently. Proper maintenance and timely upgrades of these assets are essential to avoid operational disruptions and ensure productivity. Additionally, tangible fixed capital is subject to wear and tear, making it necessary to account for depreciation in financial planning. Companies often use methods like straight-line or declining balance depreciation to systematically reduce the book value of these assets over time.

- An organization with significant fixed assets or operations tied to fixed assets should expect a ratio greater than one.

- For instance, a cybersecurity company might list computer equipment as a fixed asset.

- If you’re a stock investor or an employee of a public company, you may be interested in seeing what a company reports as its current and fixed assets, and how these numbers change over time.

- Assess where you’re at and identify what would streamline your operations.

- Current assets are used to facilitate day-to-day operational expenses and investments.

- Governments often offer these benefits to encourage investment in specific sectors or technologies, such as renewable energy or advanced manufacturing.

By leveraging technology and thoroughly understanding the intricacies of successfully managing fixed assets, a business can boost its overall financial health. Depreciation represents the value reduction of a capitalized asset over time. Fixed assets are important in business mainly because they help you produce products or deliver services – and ultimately earn revenue.

Its recorded value on the balance sheet is adjusted downward to reflect that it is overvalued compared to the market value. The fixed asset turnover ratio determines a company’s efficiency in generating sales from existing fixed assets. A higher ratio means fixed assets are being used more adequately than a lower ratio.

Asha, the owner of Asha builder, is unsure how she should account for buildings in her books of account as this was her new business. So she has approached an accountant to help her decide how these buildings cost and https://www.bookstime.com/ sell should be recorded in books of accounts. Two major types comprise to make net fixed assets of an organization. A change in net fixed assets’ market value is accounted for through a revaluation of fixed assets.

Tax & Accounting

Leasehold properties, patents, and copyrights are examples of such assets. All assets have a useful life and every machine eventually reaches a time when it must be decommissioned, irrespective of how effective the organization’s maintenance policy is. The cost of the asset minus its residual an example of fixed assets is value is called the depreciable cost of the asset. However, if the asset is expected not to have residual value, the full cost of the asset is depreciated. The purchase price of an asset is its cost plus all other expenses paid to acquire and prepare the asset to ensure it is ready for use.

- These assets are considered fixed, tangible assets because they have a physical form, will have a useful life of more than one year, and will be used to generate revenue for the company.

- Assets refer to anything that has economic value and can be converted into cash.

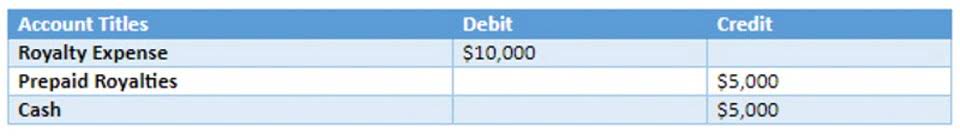

- When a company purchases a fixed asset, they record the cost as an asset on the balance sheet instead of expensing it onto the income statement.

- Two major types comprise to make net fixed assets of an organization.

- They can then spread these numbers across the period they think they’ll use the mixer—perhaps over the next five years.

This is to reflect the wear and tear from using the fixed asset in the company’s operations. Depreciation shows up on the income statement and reduces the company’s net income. Fixed assets refer to long-term tangible assets that are used in the operations of a business. They provide long-term financial benefits, have a useful life of more than one year, and are classified as property, plant, and equipment (PP&E) on the balance sheet. Regular maintenance and timely upgrades are also critical components of fixed capital management. Preventive maintenance can extend the useful life of assets, reduce downtime, and prevent costly repairs.

No Comments