08 Dic 8 2: Special Journals Business LibreTexts

Initially, the details of the inventory purchase, including the quantity, price, and terms of sale, are determined. The account credited is the name of the company, so it is going to be Brown Manufacturing. We would be crediting the Brown Manufacturing account because we (Power Tools) owe them money. Sometimes, the entity also includes other information related to purchasing like fixed assets, inventories, or expenses. Finance Strategists has an advertising relationship with some of the companies included on this website.

Books

The other account where we will record a balancing debit entry will be the Office Supplies account. Accounting journals are a great way to break down income and spending into more manageable categories. Purchase journals offer the benefit of tracking and categorizing spending over time to see how when is the earliest you can file your tax return a business is spending money. When the time comes to create your annual budget, a purchase journal helps you estimate how much you’ll need in the coming year for various business expenses. The balance in this list is compared with the balance in the general ledger accounts payable account.

How often should I update my purchases journal?

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

MS. RACHEL AND THE SPECIAL SURPRISE

This entry reflects the acquisition of inventory without the immediate outlay of cash, increasing both the company’s assets (inventory) and liabilities (accounts payable). Journal entries are recorded in the «journal», also known as «books of original entry». A journal entry is made up of at least one account that is debited and at least one account credited. Management typically uses this journal to track the status of each purchase, the amount owed to vendors, the due dates of each balance, along with the discount periods.

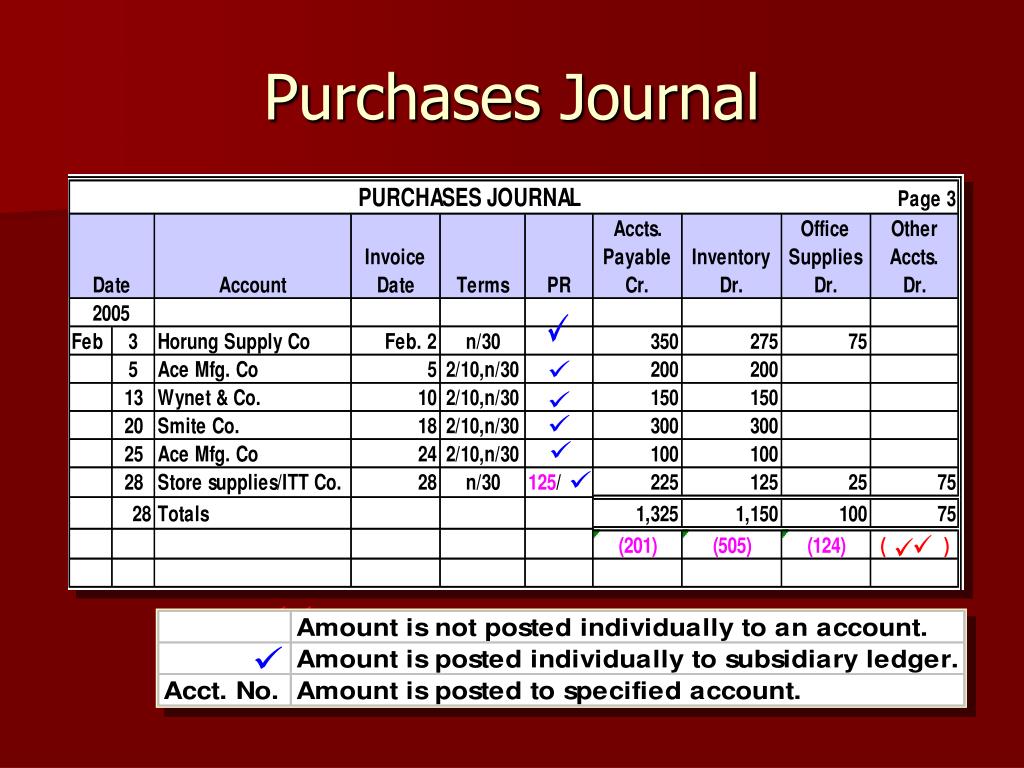

- All of these columns use source documents that were acquired throughout the voucher system.

- This entry typically involves debiting the Inventory account to increase the company’s assets, showing that inventory has been added to the stock.

- An inventory purchase journal entry records the acquisition of goods that a business intends to sell.

- You may balance accounting journals weekly, biweekly, or monthly, depending on your business needs.

our end-of-day newsletter where we process the stuff.

The New York Times has been involved in several controversies in its history. The Times maintains several regional bureaus staffed with journalists across six continents, and has received 137 Pulitzer Prizes as of 2023, the most of any publication, among other accolades. Under ASC 805, acquired goodwill must be stated at its fair value and is to be identified separately from other identifiable intangible assets, the fair value of which is recognized and stated separately. ASC 805 replaces FAS 141 which applied to business combinations prior to December 15, 2008. This increases the inventory, reflecting the addition of landscaping materials. This increases the inventory, reflecting the addition of gardening tools.

You can see how these journal entries (using the perpetual inventory method) would be recorded in the general ledger as by clicking fooz ball town to save space. Note that we are adding this next transaction to the previous one since the Purchases Journal lists all the credit purchases for the period in chronological order. As with the previous example, we will enter the date and the name of the account – Eco Supplies. When you have expenses with a vendor, you may be recording them with a Purchases Journal.

You need to note which account funds are taken from to pay for a purchase. Periodically, and no later than the end of each reporting period, the information in the purchases journal is summarized and posted to the general ledger. This means that the purchases stated in the general ledger are only at the most aggregated level. If a person were researching the details of a purchase, it would be necessary to go back to the purchases journal to locate a reference to the source document.

Let’s illustrate with examples for a company named “Garden Supplies Co.” that purchases inventory both in cash and on credit. The cash receipts journal is used to record all receipts of cash for any reason. Anytime money comes into the company, the cash receipts journal should be used.

The Purchases Journal is a specialized type of bookkeeping log that keeps track of orders made by a business on credit or on account. It should be noted that cash purchases of merchandise are not tracked in the Purchases Journal. If there is a small number of transactions of credit purchases, then the entity might record the purchase journal together with other transactions. This special journal is prepared for reducing the large of transactions in the general journals.

The accounting department uses this journal to crosscheck and tie out the accounts payable subsidiary accounts at the end of each period. In some cases, an expense may come from several internal accounts because multiple products or services are on a single invoice. When this happens, it is important to note the individual amounts of each product or service along with the invoice number for accurate tracking. If you also make records of the debit from a spending account in a different journal, all of the information should match. This makes it easier to go back and compare transactions to make sure everything matches up in the case of an audit. Recordings of these transactions should be following the debit and credit roles.

The subsidiary (customer) ledgers would be updated daily but at the end of the period, the TOTALS only would be recorded in posted directly into the accounts listed with no journal entry necessary. It is also known as a Purchase journal, Invoice book or Purchase daybook. A purchase book is a special-purpose subsidiary book prepared by a business to record all credit purchases. Nowadays all these recordings occur in ERPs and only small firms resort solely to notebooks or MS Excel. It regularly orders food and supplies for its bar from various suppliers. When the kitchen manager places an order for $100 of inventory with a vendor, Buckley typically has 30 days to pay for the order.

No Comments